– Insights from Toronto Realtor Richard The Toronto rental market is evolving, with a major housing deal aiming to ease affordability challenges. The federal government has pledged $2.55 billion in low-cost financing to build nearly 5,000 rental units, with over 1,000 designated as affordable housing. The City of Toronto is also offering financial incentives toContinue reading “How Toronto’s Housing Market is Impacting Single Renters”

Category Archives: News

Bank of Canada Cuts Policy Rate by 25 Basis Points to 2.75%

Bank of Canada Lowers Overnight Rate to 2.75% Amid Economic Uncertainty The Bank of Canada announced today that it has reduced its target for the overnight rate to 2.75%, with the Bank Rate set at 3% and the deposit rate at 2.70%. While the Canadian economy entered 2025 on solid footing, with inflation near the 2% target and strong GDP growth, rising trade tensions and U.S. tariffs are expected toContinue reading “Bank of Canada Cuts Policy Rate by 25 Basis Points to 2.75%”

Bank of Canada Likely to Cut Interest Rates

Balancing weaker economic growth but higher inflation, central bank may trim rate by 25 basis points to 2.75 per cent Bank of Canada Likely to Cut Interest Rates on Wednesday Amid Ongoing U.S. Trade Uncertainty The Bank of Canada is widely expected to announce an interest rate cut this Wednesday as economic uncertainty, particularly surroundingContinue reading “Bank of Canada Likely to Cut Interest Rates”

How to Calculate What You Can Afford

What You Can Afford in Toronto A Comprehensive Guide Buying a home in Toronto is an exciting milestone, but before you start browsing listings, it’s essential to determine how much you can afford. Understanding your budget will help you focus on properties within your price range and avoid financial stress down the road. In thisContinue reading “How to Calculate What You Can Afford”

GTA Housing Inventory Stays High

Giving Buyers More Options and Negotiation Power. GTA Real Estate Market Update – February 2025: More Choices & Negotiation Power for Buyers Homebuyers in the Greater Toronto Area (GTA) continued to benefit from a high inventory of resale homes in February 2025. While sales were lower compared to the same period last year, the increaseContinue reading “GTA Housing Inventory Stays High”

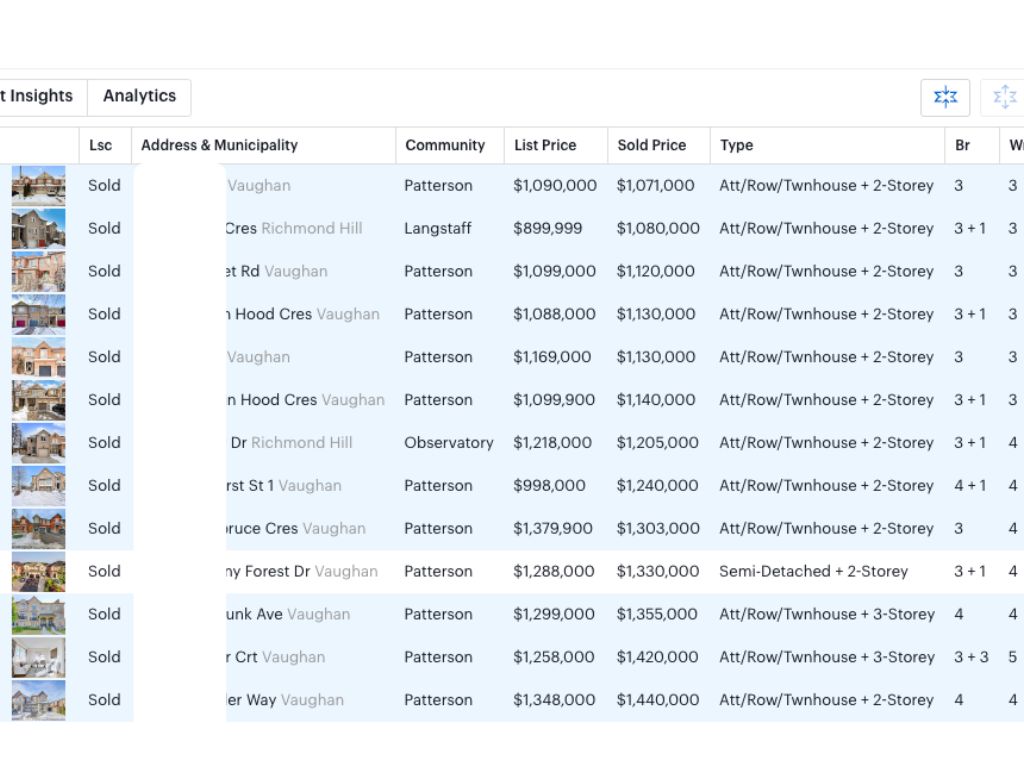

SOLD Record in Patterson Vaughan Feb 2025

SOLD Freehold townhome in Feb 2025 in Patterson of Vaughan Patterson Vaughan Freehold Townhome Market Update – February 2025 The Patterson Vaughan real estate market continues to experience a slowdown, with home prices remaining below their peak from early 2022. While houses are still selling, the pace has slowed as many buyers wait for theContinue reading “SOLD Record in Patterson Vaughan Feb 2025”

What to Expect for the Rental Market in 2025?

A recent survey reveals that two-thirds of renters in the Greater Toronto Area (GTA) are at their limit, stating they cannot tolerate further rent increases. This growing concern highlights the mounting pressure on affordability in one of Canada’s most competitive housing markets. TRREB’s Comprehensive Market Analysis The Toronto Regional Real Estate Board (TRREB) has released its Market Outlook and Year inContinue reading “What to Expect for the Rental Market in 2025?”

BoC Cuts Interest Rate to 3%

In the ever-evolving world, the art of forging genuine connections remains timeless. Whether it’s with colleagues, clients, or partners, establishing a genuine rapport paves the way for collaborative success.